Building Math Skills Computing Gross and Net Pay

Her deductions are 25 to be subtracted from gross earnings. Start studying the Workplace Readiness Skills 18-22 flashcards containing study terms like Online documents compatibility Vulnerability to security and confidentiality issues and more.

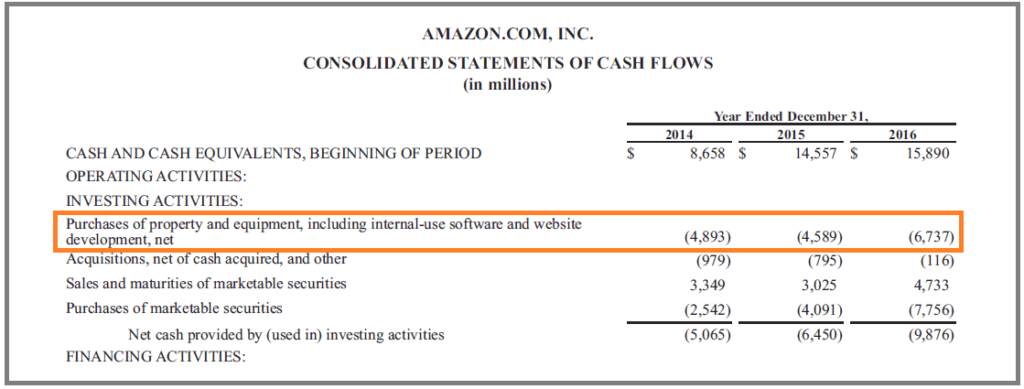

Capital Expenditure Capex Guide Examples Of Capital Investment

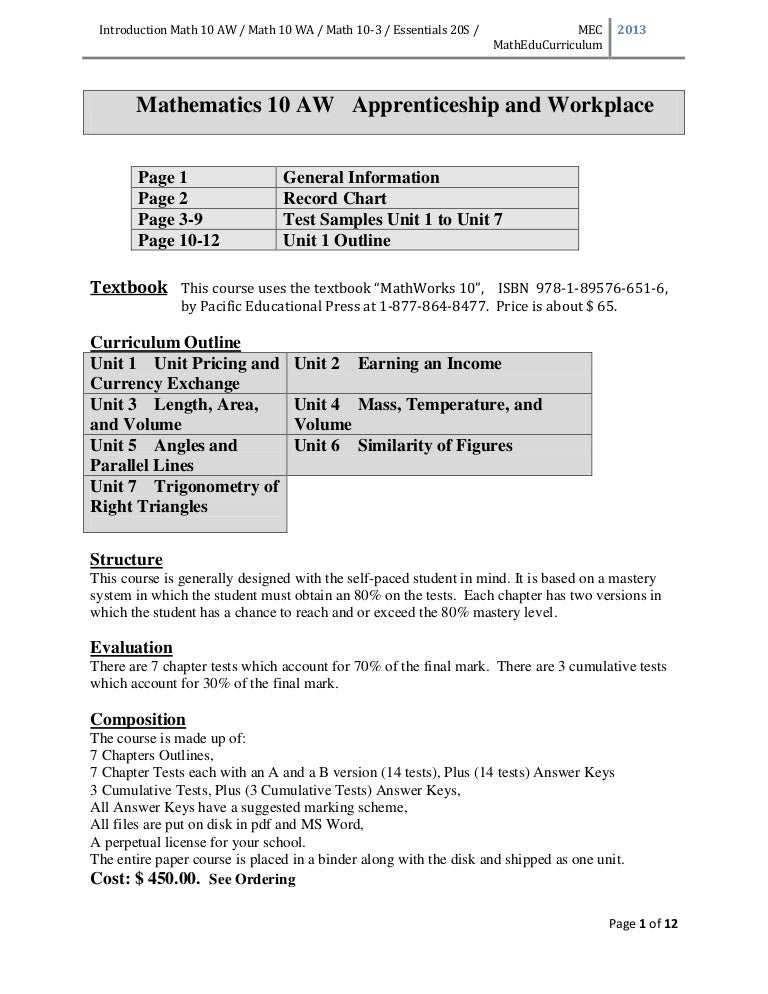

Solve problems that involve unit pricing currency exchange and proportional reasoning.

. Investigating payroll tax and federal income tax withholding. To compute the gross pay of employees with an annual rate divide the total amount of yearly pay by the number of pay periods within a year. Mathematics concepts and skills in buying and selling computing gross and net earnings overtime and business.

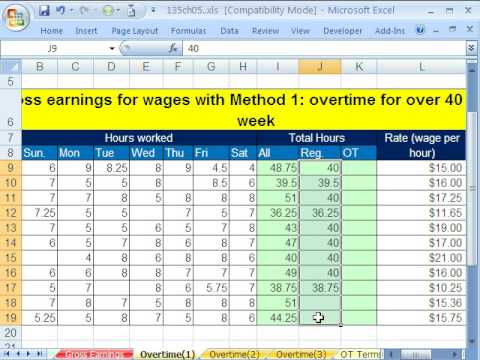

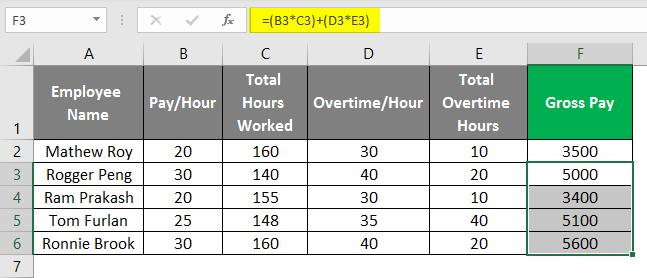

It includes a review of the fundamental mathematics operations using decimals fractions percent ratio and proportion. Gross Income Gross Revenue Cost of Goods Sold. Gross pay includes regular hours times regular pay plus overtime hours times overtime pay.

Net pay is the amount people receive after taxes and other deductions are taken out of gross pay. Net income is gross income minus all the taxes and other deductions. 93 The hourly employees in your department worked a total of 7350 hours this week.

Net Pay from FINANCE Personal F at Rolla Sr. Financial Math3C D analyze and interpret payroll deductions including federal taxes state taxes and city taxes using current tax rates. Monthly you make a gross pay of about 2083.

She makes 925 an hour and works 32 hours a week. Complete the following problems. Compute his weekly pay.

Section 1-6 Calculate the straight commission and determine the gross pay. Memorize flashcards and build a practice test to quiz yourself before your exam. Assume that the gross revenue of ABC a paint manufacturing company totaled 1300000 and the expenses were as follows.

Brick Undergrounds Gross Rent Calculator enables you to easily calculate your gross rent make quick apples-to-apples comparisons between apartments and avoid expensive surprises. All youll need to figure out. To create a realistic budget and ensure you have enough money to cover your necessary monthly expenses its helpful to base your monthly budget on.

Review information on how to read a pay stub and answer questions about earnings and deductions. For purposes of an example lets assume an unmarried individual lives with an annual salary of 48000. Calculate her net pay for two weeks.

Calculate tax withholdings deductions and the difference between gross income and net income. Demonstrate an understanding of income. Computing Gross and Net Pay Directions.

Sams rate of pay is 675 per hour. EXERCISE 2-3 I Building Math Skills. If youve been talking about paychecks in your class this worksheet is a good practice.

To calculate your net pay subtract 700 your deductions from. EXERCISE 2-5 Building Math Skills. It includes 5 sample paystubs.

Financial knowledge and decision-making skills Grade level. Financial Math3B C differentiate among and calculate gross net and taxable income. What students will do.

People pay a percentage of their income in taxes. Students analyze W-4 forms and pay stubs in order to better understand payroll taxes and federal income tax withholding. High school 912 Age range.

Deductionsboth required and voluntaryare subtracted from gross pay to compute. Math 10-3 Course Planning. Gross pay is the amount people earn per pay period before any deductions or taxes are paid.

Calculate the difference between gross income and net income. It only factors in the total amount of purchases made. Difference between gross sales and net sales.

His monthly job hours are 80. Adding the price of the laptop 740 and the sales tax 37 results in the total cost of 777. Tare weight Net weight Gross weight.

Unit 1 - Wages Students begin the Business Math course learning about different ways that wages are handled. This is what is known as take-home pay. Computing Gross and Net Pay Directions.

F calculate net pay. Section 1-2 Figure out straight-time overtime and total pay. The overtime pay rate is 1½ times the regular rate of pay.

Calculating Gross Pay for Salaried Employees. G compare and contrast between independent contractor earnings and employee earnings including tax requirements tax forms W-2 W-4 1099 and Form 941 and benefit requirements. Complete the following problems.

Income tax is a tax on the amount of income people earn. Cost of raw materials. Section 1-4 Compute the total pay on a piecework basis.

Students will need to calculate gross income Social Security Medicare total deductions and Net Pay. Gross pay - taxes withheld - deductions withheld net pay Start with the gross pay or salary. Use the example of a 740 laptop computer in a state with 5 sales tax.

This amount is considered your gross pay. H calculate the various earnings as affected by the laws related to minimum wage. Gross sales sum of all sales.

Max earns 750 per month. Applied Math Business Other Math Grades. Section 1-3 Calculate the total hours on a weekly time card.

BUILDING BLOCKS TEACHER GUIDE. Gross Weight - Tare Weight Net Weight. The net effective rent is less than the amount you will actually have to pay --- known as your gross rent --- during your non-free months.

View PF Ch 2 Computing Gross. Applies mathematical skills to complete tasks as necessary. For example if the employees annual pay is 12000 and there are 24 pay periods in a year their gross pay per period is 500.

Unit 2 - Taxes and Budgeting In this unit students investigate various taxes including state and federal income tax social. They study hourly wages overtime pay weekly time cards and piecework pay as well as salary and commission. Lets say your yearly salary is 25000.

To calculate gross sales simply add the total amount of incoming sales throughout a specific period of time. The formula for calculating the gross income or gross profit of a business is as follows. 800 X 12 9600 per year.

Section 1-5 Determine the salary per pay period. Explain that one tax people pay is federal income tax. Use the following formula to calculate your net pay.

While sales tax is added to the starting amount of a purchase. Remember that the amount you get does not factor in discounts returns or any later modifications to pricing. Net pay gross pay - deductions.

You determine that your monthly deductions amount to 700. Compute his yearly salary. EXERCISE 1-3 Building Math Skills.

Up to 24 cash back Numbers 34 Develop number concepts and critical thinking skills. 675 X 32 21600. Understand what types of taxes are deducted from a paycheck.

Section 1-1 Calculate straight-time pay. He worked 32 hours last week. The total weight of a shipment which includes the weight of the container and the items within.

Jim makes 800 per month. First show how 5 is converted to the decimal 05 and multiplied by 740 to arrive at a sales tax of 37.

Calculating Gross Pay Teaching Resources Teachers Pay Teachers

Mathematics For Work And Everyday Life

Pf Ch 2 Computing Gross Amp Net Pay Exercise 2 3 I Building Math Skills Computing Gross And Net Pay Directions Complete The Following Problems Course Hero

Pf Ch 2 Computing Gross Amp Net Pay Exercise 2 3 I Building Math Skills Computing Gross And Net Pay Directions Complete The Following Problems Course Hero

Gross Pay And Net Pay Teaching Resources Teachers Pay Teachers

Gross Pay And Net Pay Teaching Resources Teachers Pay Teachers

Computing Net Pay Docx Computing Net Pay Kerry Worked 46 Hours Last Week His Hourly Rate Is 6 60 He Has The Following Deductions Taken From His Course Hero

Calculating Gross Pay Teaching Resources Teachers Pay Teachers

Pf Ch 3 3 Computing Unit Prices L 1 Mes Taylor A Rolla High School Name Chapter 3 3 14 Points Directions Answer All 2 Pt Questions In Course Hero

Pf Ch 3 3 Computing Unit Prices L 1 Mes Taylor A Rolla High School Name Chapter 3 3 14 Points Directions Answer All 2 Pt Questions In Course Hero

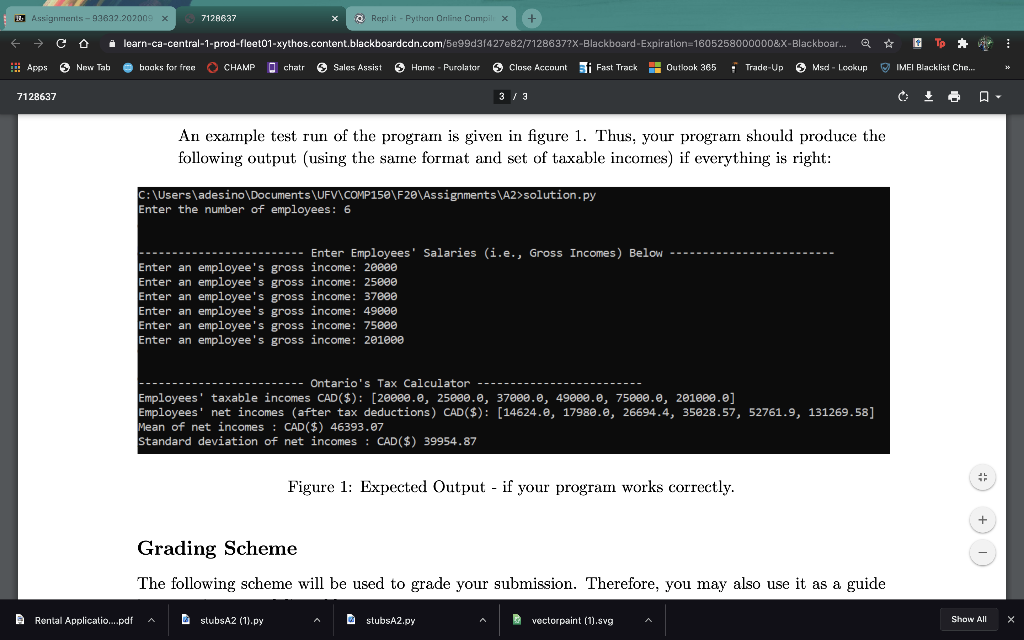

Unit 2 Formula And Functions Information Systems

Solved Assignments 93622 202009 X 7128637 Repl It Chegg Com

Gross Pay And Net Pay Teaching Resources Teachers Pay Teachers

Mathematics For Work And Everyday Life

Pf Ch 3 3 Computing Unit Prices L 1 Mes Taylor A Rolla High School Name Chapter 3 3 14 Points Directions Answer All 2 Pt Questions In Course Hero

Introduction Math 10 Aw Math 10 Wa Math 10 3 Essentials 20s

Excel Busn Math 38 Gross Pay And Overtime 5 Examples Youtube

Computing Net Pay Exercise 2 3 Computing Gross And Net Pay Directions Complete The Following Problems Gross Pay Includes Regular Hours Times Course Hero

Comments

Post a Comment